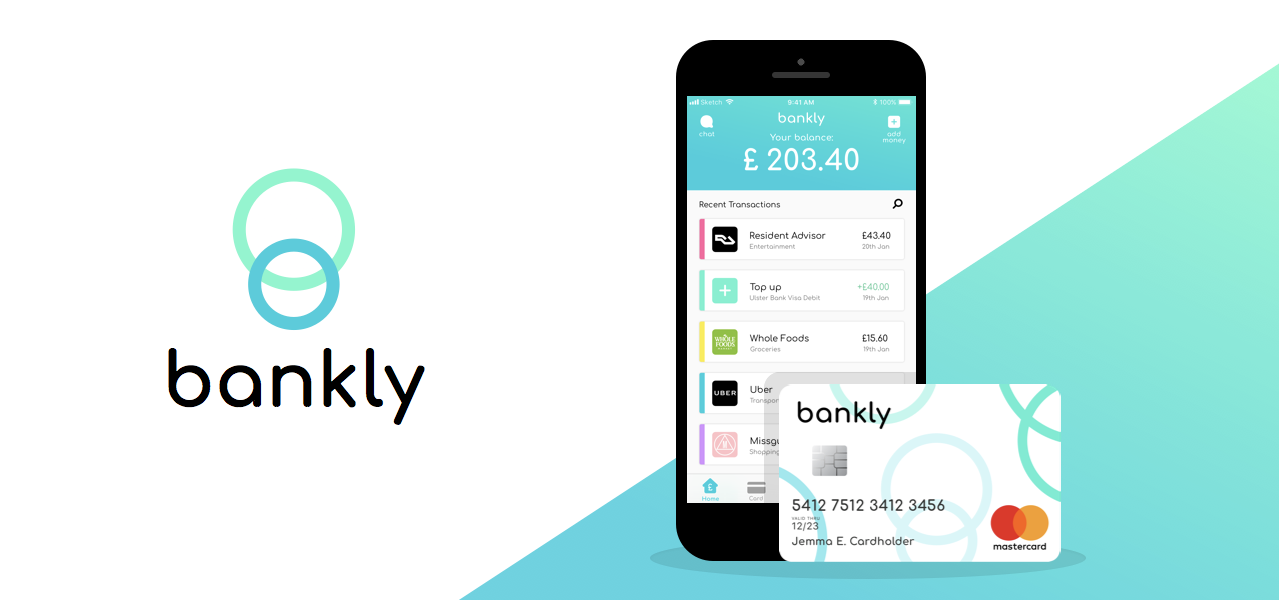

Nigeria’s fintech sector is thriving, with startups like Payaza and Bankly making waves in 2025. Payaza, a Nigerian payments fintech, recently received SEC approval to raise ₦20 billion under its ₦50 billion commercial paper program, as reported by Techpoint Africa. This funding will expand its payments infrastructure, deepening financial inclusion across Africa. Similarly, Bankly, another Nigerian fintech, was fully acquired by C-One Ventures, enabling it to scale its HR and payroll technology tailored for African businesses.

These developments reflect Nigeria’s position as Africa’s largest ICT market, with 82% of the continent’s telecom subscribers and 29% of internet usage. Fintechs are addressing critical gaps, such as the 66% of adult Africans who lacked bank accounts in 2014, by offering mobile-based financial services. Companies like Paga, which has processed over $2 billion in payments, continue to drive this transformation. On X, users are buzzing about fintech’s role in empowering small businesses, with innovations like Visa’s support for 67 million SMBs globally by 2023 inspiring local efforts.

The Federal Government’s Llama Impact Accelerator, launched with Meta, is further fueling fintech innovation by supporting startups tackling national challenges. As Nigeria’s digital economy grows, fintechs like Payaza and Bankly are poised to lead, offering scalable, inclusive solutions for the unbanked and underserved.

Ready to Transform Your Tech Vision into Reality? 📞 Contact McGate Technologies Today! Whether you're launching a project or need expert guidance, our team is here to help you innovate, scale, and succeed. 👉 Get in touch now — Let’s build the future together!